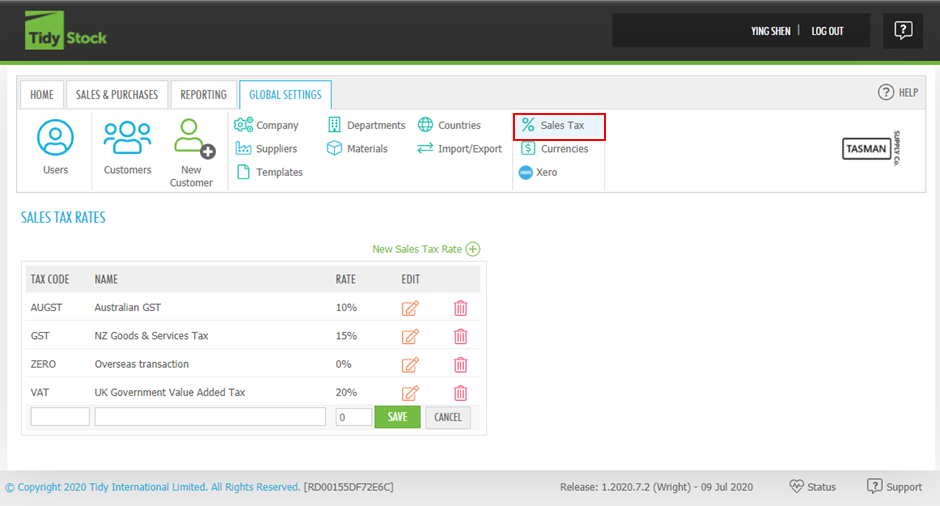

Sales tax

The Sales Tax settings in TidyStock allow you to add any sales tax options relevant to your business. The system will allow you to add as many different sales tax options as you need, which is particularly helpful if you do business with customers/suppliers in multiple different countries and regions where the tax requirements may differ. These values can also be mapped back to the appropriate accounts in Xero. Add a new sales tax rate using the New Sales Tax Rate link.

Enter the Tax Code in capitals, the Name of the tax code and the rate. These tax codes will be the same as the tax codes used in your Xero or Reckon account. When connected to Reckon the values of the TidyStock Sales Tax Rates and the Reckon Tax Rates must be the same.

You can also delete Tax Rates that are not used by clicking  button, or edit the Tax Rates by clicking

button, or edit the Tax Rates by clicking  button.

button.

Tax Rates are then populated in a drop-down list within Create and Edit Project (required information) and also in the Financial Information tab for Customers.